GOING GLOBAL

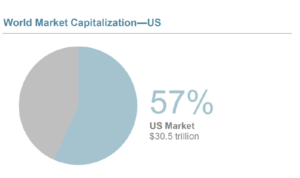

More than half of the publicly traded companies in the world are based outside of the United States. In this brief, I explore why now may be a good time to own—and potentially add to— global equities.

WHY GLOBAL EQUITIES?

As investors, we have countless investment opportunities to consider. Stocks, bonds, real estate, derivatives, commodities, alternative investments, private equity, and more. Within each of these asset classes we find further opportunity—large companies, small companies, international, domestic, and so forth.

When we invest in a stock (the equity of a firm), we are effectively buying a piece of a public traded company which means we share in the profits—and the losses—generated by the firm. Unlike many other investments with caps on return potential (e.g., bonds) equities offer the potential of limitless upside. But also like bonds, stockholders may realize absolute loss of principal on the downside. As a result, stocks generally offer higher return potential, but understandably come with more risk. Because of the uncertainty involved with stocks, we generally suggest diversifying across a large number of firms so as to minimize the potential loss that can come from having too many dollars in one company.

One of the ways we seek to diversify is by region. Investing in global equities means owning stocks of companies that are based in countries worldwide. It can also mean investing in domestic companies that derive a meaningful portion of their revenues from overseas such as Coca-Cola, a U.S. based firm, which derives more than 80% of its income from outside of the United States*.

AVOIDING HOME BIAS

Worldwide, investors tend to exhibit something referred to as home bias which means that we often invest more in companies of our home country. If you’re an investor from Ireland, you’re likely to own more stocks based in Ireland. But given that more than half of the publicly traded companies in the world are based outside of the U.S., embracing a more globally diversified portfolio can make sense—and perhaps now more so than ever.

As the second chart on the following page shows, investors who embraced U.S. stocks over the past few years have largely been well-rewarded. But history shows us that market returns, by geography, tend to rotate over time. While the U.S. may continue to dominate returns, I think investors would be wise to embrace ownership across multiple regions. To further support this notion, consider that numerous countries have been able to contain the coronavirus outbreak and are now restricting travel from the United States. As a result, we may see this benefit international firms more so than U.S. firms as we seek to bring our virus numbers down.

WHY NOW?

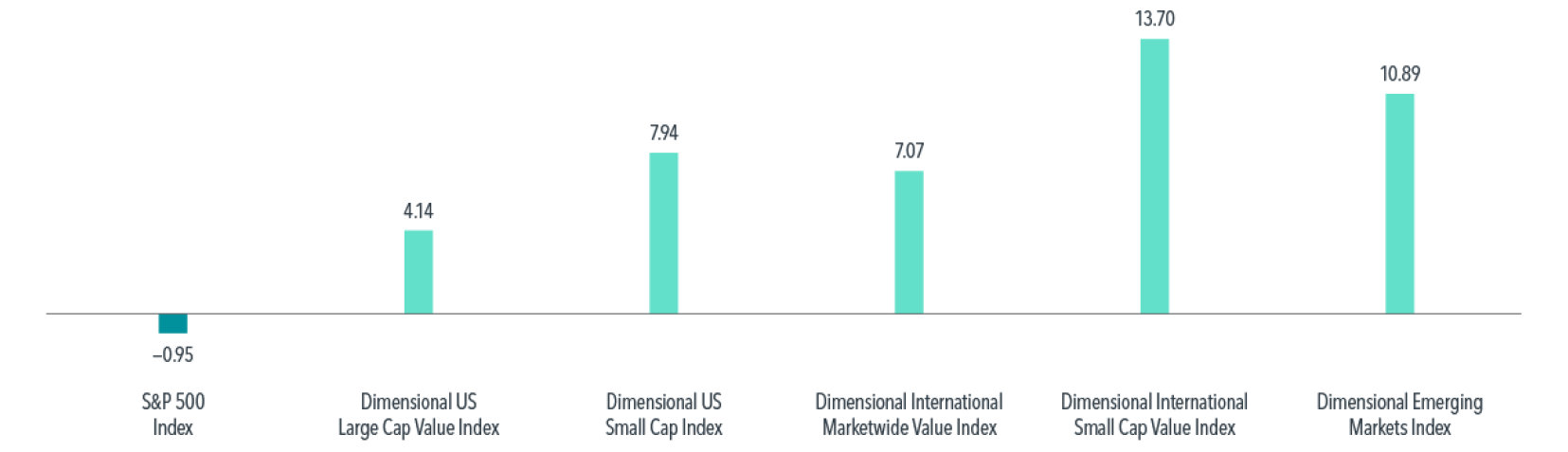

It’s hard to deny that the U.S. equity markets have led the world in terms of market performance over the past several years. But history tells us that periods of relative outperformance may be followed by periods of underperformance. For example, from 2000 through 2009, the S&P 500 provided an annualized return of –0.95% (yes, negative, on a yearly basis for 10 years), as shown below.* This period is often referred as to the “lost decade.”

However, from 2010-2019, the same S&P 500 sported an annualized return of 13.56% notably besting other markets as depicted below.

CONCLUSION

Markets are extremely difficult to predict and forecast, and now so more than ever. Thus, it would seem prudent to at least prepare for various outcomes by diversifying across markets. And right now it’s hard to deny that markets are faring better than expected given the challenges currently facing the economy. But in my view, it’s worth noting that where you invest can make a world of difference.

Jeff DeLarme, CFP®

Registered Principal, Financial Advisor

Disclosures

The information in this writing has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services or DeLarme Wealth Man-agement and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purpos-es only and does not constitute a recommendation.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any opinions are those of DeLarme Wealth Management, and is not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected individual investor’s results will vary.

The S&P 500 is an unmanaged index of 500 widely held stocks, and cannot be invested in directly.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. Investment advisory services offered through Raymond James Financial Services Advisors, Inc. DeLarme Wealth Management is not a registered broker/dealer, and is independent of Raymond James Financial Services.

*Sources: Coca Cola Annual Report https://d1io3yog0oux5.cloudfront.net/_79ed336a13aa70c87e30d9a138c6846f/cocacolacompany/db/734/7242/annual_report/coca-cola-business-and-sustainability-report-2019+%281%29.pdf and chart data/graphics courtesy of Dimensional Fund Advisors