Which “market?”

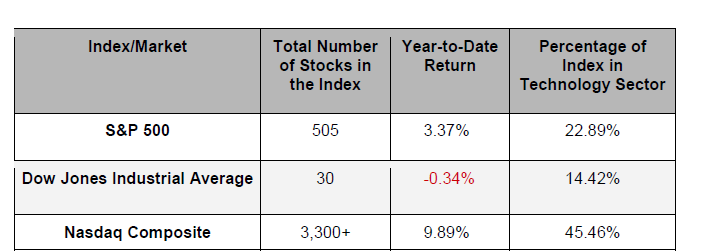

People often talk to me about the market and what it’s doing – or in some cases – not doing. I regularly receive unsolicited comments such as: “the market is on fire” or “the market is way too high – it’s about to crash” or “my friend told me to just buy an index fund that tracks the market.” When I hear these comments, I typically reply with, “which market are you referring to, exactly?” Here’s what I’m really asking – are we talking about the U.S. equity (stock) markets and if so, are we talking about Large U.S. equities, or Small U.S. equities? Value or Growth equities? Or perhaps global equities? My guess is that in most cases, people are referring to the U.S. equity markets – and they’re probably getting their information by looking at the S&P 500 Index, the Dow Jones Industrial Average Index, or the Nasdaq Composite Index. But the trouble with using these indices for purposes of evaluating the “market” is that they often tell very different stories. Hopefully the table below will help explain what I mean:

Source: Morningstar, as of July 5, 2018

The table above highlights three of the more commonly referenced equity (stock) indices as well as the number of stocks included in the index, their respective year-to-date return, and interestingly, the amount that each index is allocated to technology stocks.

The first takeaway you’ll likely notice is the difference in returns across these three “markets.” Someone looking at the Dow might be disappointed with the market this year, while someone paying attention to the Nasdaq Composite would likely be pleased. But as you probably figured out on your own, one of the drivers behind the disparity of the above returns is the amount that each index is allocated to – or tracks – technology companies. It should be no surprise then that technology stocks in general have been performing well in 2018, as evidenced by the strong year-to-date return in the technology-heavy Nasdaq Composite Index.

The second takeaway is while the “market” may be hitting new highs – and yes that may be a scary time to invest money or stay invested – there are likely segments of the market that are not hitting highs, and those segments may present attractive investment opportunities.

The following table shows that not all aspects of the “market” have performed the same for 2018:

Source: Morningstar, as of 7/5/2018

What this means for investors

I believe there are a few considerations that investors can take away from this information. The first is to consider if owning an investment that simply tracks an index – without concern for its underlying composition – is appropriate for their goals and risk tolerance. This form of investing, referred to as passive investing or index investing, has become very popular over the past few years, but I’m concerned that the potential downsides of this approach haven’t been discussed to the same extent as their purported benefits.

Another consideration is that investing in the “market” via a fund that tracks an index – such as the Nasdaq Composite referenced earlier – may actually result in a lack of diversification despite, being invested in thousands of stocks. Why? Because as illustrated in the table above, more than 40% of the index is invested in the technology sector alone. This may be great news while tech stocks are on the rise, but when they decline, it’ll be a different story.

In addition, looking at the “market” can often be misleading for investors. The reality is that many companies and sectors have actually performed quite poorly as of late, and in some cases may present attractive investment opportunities. But to someone who sees that the “market” just hit another high, they may feel that all prices are too rich (when, in reality, perhaps just one or two sectors appear to be overpriced). Instead, investors should consider evaluating their personal progress relative to a blended index better matched to their unique portfolio.

I’ll close by saying that I’m not looking to pick on technology companies, but rather to understand and call-out when any one industry or sector appears to be the dominant source of returns in an index – and therefore, a potential risk to investors.

So the next time someone says, “the market is really hot right now” or “the market is tanking” – you may pause to ask, “which market?”

The S&P 500 index is owned by the Standard & Poors company and cannot be invested in directly. The Nasdaq Composite Index is owned by Nasdaq and cannot be invested in directly. The Dow Jones Industrial Average is owned by Dow Jones (News Corp) and cannot be invested in directly. Investing involves risk. Past Performance is no guarantee of future results. This wealth briefing has been written for educational purposes and is not a solicitation to invest or buy securities and does not constitute investment advice.. Any data included or referenced has been sourced from what are believed to be reliable sources, but should not be relied upon.