MARKET MALAISE?

The first four months of the year are in the books, and the equity markets are mostly flat in terms of returns. What we have seen in this first trimester is the return of volatility, and our first 10% correction in well over a year. Understandably, many investors are wondering if the markets are primed to run up from here, fall, or zig and zag but stay relatively flat. History may be a useful guide here…according to the chart below, declines of 10% have historically been better buying opportunities than reasons to sell.

*Source: Dimensional Fund Advisors. Market decline of 10% is defined as a month in which cumulative return from peak is -10% or lower. Annualized compound returns are computed for the 1-, 3- and 5-year periods subsequent to a market decline of at least 10%. 1,093 observations for 1-year look-ahead. 1,069 observations for 3-year look-ahead, and 1,045 for 5-year look-ahead. 1-year, 3-year, and 5-year periods are overlapping periods. The bar chart shows the average returns for the 1-, 3-, and 5-year period following a market decline of at least 10%. January 1990–Present: S&P 500 Total Returns Index. S&P data © 2016 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. January 1926-December 1989; S&P 500 Total Return Index, Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago. For illustrative purposes only. Index is not available for direct investment; therefore, its performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is no guarantee of future results. There is always a risk that an investor may lose money.

Rising rates

We continue to keep an eye on interest rates and the potential of an inverted yield curve, which research suggests may foreshadow a recession (see our March Wealth Briefing). So far, rates have increased in the short-term but also in the intermediate-term, with the 10-year U.S. Treasury Bond recently hitting 3.0% for the first time since January 2014. This is seemingly good news for fixed-income investors and savers who may notice higher rates on their bank and money-market accounts. For borrowers of student loans, cars, or home mortgages, rising rates may become a more prominent headwind. For now, we’ll keep rising rates in perspective as according to data compiled by Raymond James and Freddie Mac, the 30 year mortgage rate was just 4.62%, up from 4.10% a year ago, but still well below the long-term average of 8.16%. (Source- Raymond James, Freddie Mac, May 4, 2018.)

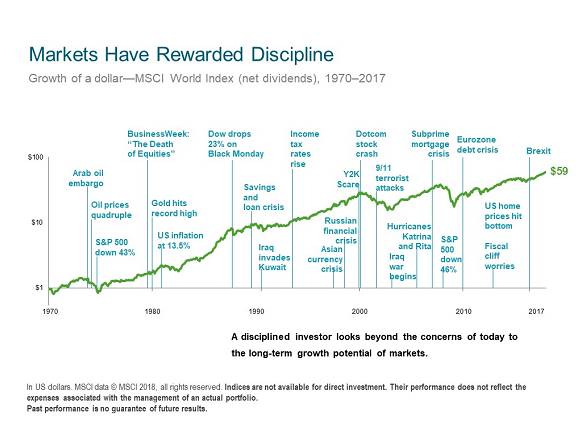

When the markets are volatile, and there seem to be more headlines supporting an imminent decline in the markets or economy, I think it’s important to remember that, as investors, we are often rewarded for our discipline, as highlighted below.

*Source: Dimensional Fund Advisors

Summer months

I’m excited to share that on May 7th, one of our clients – someone I’ve worked with since 2008 – turned 100 years young! Every time I visit with Thelma and her granddaughter, I’m reminded of why I’m in this business. I’m also reminded to save and invest for the long-haul because, if we’re lucky and prepared, you might be spending more years retired than you did working.

Later this month, I’ll be heading to Washington, D.C. for the Raymond James National Conference for Professional Development – an annual conference where many advisors from across the U.S. gather to share ideas, resources, and meet thought leaders in our industry. I’ll also be in New York for a 5-day workshop, preparing for Level 2 of the Chartered Financial Analyst exam. Michelle will be holding down the office, and I will be available via email or phone should you need to reach me while I’m away. In June and July, we’ll be reaching out to schedule annual reviews should you like to sit down and discuss your personal situation.

Thank you for reading these Wealth Briefings. I hope you find them to be insightful, informative, and….brief. Michelle and I are here for you with any questions you may have about your portfolio, the progress toward your important financial goals, or anything else related to your finances.

We appreciate your trust, confidence, and friendship.

The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI World Index is designed to measure the equity market performance of developed markets. The 10-year Treasury Note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. Bank accounts offer FDIC insurance and a fixed rate of return whereas the return and principal value of investment securities fluctuate with changes in market conditions. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices rise. No investment strategy can guarantee success.